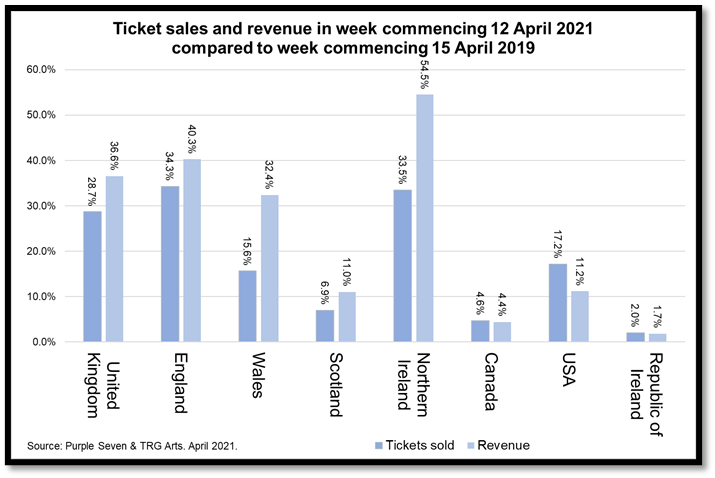

UK Sees Evidence Of Revival In Advance Ticket Sales While Scotland, US, Canada & Ireland Show Little Sign Of Recovery

UK revenues up to 40% of 2019 levels with Canada (4%) and Republic of Ireland (2%) showing no signs of recovery.

New analysis of near real-time box office data from performing arts organisations in the UK, US, Canada and Republic of Ireland released today by international arts management consultants TRG Arts and UK arts data specialists Purple Seven demonstrates very different trading environments on both sides of the Atlantic, and substantial differences within the UK.

Aggregate figures paint a misleading picture of the recovery in Northern Ireland. In the week commencing 12 April 2021, Northern Ireland accounted for just 3% of the sales and revenues recorded in the UK. Just two venues accounted for 87% of revenues in Northern Ireland. Of the 17 venues in the study, 14 recorded revenues of 20% or less compared to the same week in 2019 and seven sold no tickets at all.

The outlook in England is far brighter. England accounted for 91% of all revenue achieved in the UK last week. A substantial proportion of the revival in sales in England is thanks to successful on-sales of long running shows in London, but there were also signs of the start of a strong recovery in the regions. Excluding London, ticket sales in England achieved 38% of 2019 levels and revenues were almost half (49%).

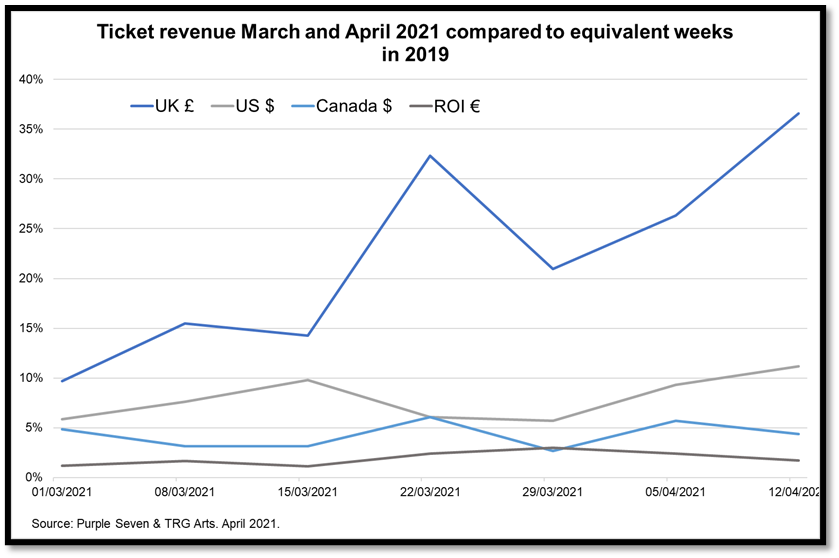

The UK's stronger sales last week appear to be part of a trend that commenced in late March 2021. Prior to this, the UK's weekly sales revenues were consistently at least 85% down on 2019. Week commencing 12 April 2021 was the first week in 2021 that sales revenues in the US were more than 10% of 2019 levels. There is no evidence of an upward trend in revenues reported from Canada or the Republic of Ireland.

The data from 349 performing arts organisations (226 in the UK, 94 in the US, 12 in Canada and 17 from the Republic of Ireland) come from the COVID-19 Sector Benchmark, an initiative led by TRG Arts and Purple Seven, which has grown into the largest global arts and cultural consumer dataset in the industry. It captures near real-time data from box office feeds of all scales. The majority of the sample are theatres, but there is also a representation of arts centres and orchestras.

"With a mixture of high levels of vaccination in the adult population, a clear roadmap for re-opening and Government support through the Culture Recovery Fund, we would hope to see the first signs of recovery in the UK's and specifically England's performing arts," said TRG Chief Executive Officer Jill Robinson. "These are very encouraging figures, but there's a long way to go. We need to let arts lovers know that their local venues are getting ready to re-open and now is the time to be showing their support by booking tickets for as many and varied future performances as they can."

COVID-19 Sector Benchmark tracks sales on a daily basis from the box offices of arts organisations. These include both funded charities and commercial arts organisations.

"If there is light at the end of this incredibly long tunnel, it seems to be burning far more brightly in some parts of the UK than others," commented Purple Seven Managing Director David Brownlee. "The aggregate figures obscure the ongoing challenges being faced by the arts sector in Northern Ireland, which is starkly demonstrated by the ongoing catastrophic drop in ticket revenue for the majority of individual venues. Scotland's cautious approach to re-opening seems to be reflected in lower sales and revenue and currently there is no sign of an upturn. There are clearly still challenging times ahead and a need for continued active support from both audiences and Governments all around the UK."

TRG Arts and Purple Seven have published a number of studies on the impact of COVID-19 pandemic on the arts and culture sector:

• February 2021, "COVID-19 and Philanthropy - Giving in 2020" https://go.trgarts.com/BenchmarkInsights_Jan2021.

• November 2020, "Ticket Sales & Philanthropy" https://trgarts.com/blog/benchmark-insights-nov-2020.html

• October 2020, "Who is Giving?" https://go.trgarts.com/InsightReport_Oct20

• September 2020, "COVID-19 and the Performing Arts - Six Months After Closure" https://trgarts.com/blog/insights-report-sep-2020.html

• August 2020, "Who is booking now? Changes in ticket buyer demographics post COVID-19" https://go.trgarts.com/InsightReport_Aug20

• June 2020, "Individual Donations - Is New Philanthropic Income Replacing Lost Ticket Income?" https://go.trgarts.com/InsightReport_July20

• May 2020, "Tracking the Initial Impact of COVID-19 on the Performing Arts in the UK and North America" https://go.trgarts.com/InsightReportMay2020

TRG Arts offers a range of free resources for cultural and arts professionals throughout the USA, Canada, the UK and the EU to ensure the field of arts and culture thrives now and after the COVID-19 crisis:

• TRG 30, a weekly 30-minute webinar series of crisis counsel and best practices that attracts hundreds of executives globally each week: https://go.trgarts.com/TRG30.

• TRG blog for the latest on COVID-19 related topics: https://go.trgarts.com/Blog

About the COVID-19 Benchmark Dashboard

Purple Seven and TRG Arts continue to offer free access to the free COVID-19 Benchmark Dashboard to organisations in the US, Canada, the UK and the Republic of Ireland. To register visit https://go.trgarts.com/benchmark.

Expansion of the COVID-19 Benchmark Dashboard is supported in part by a grant from the National Endowment for the Arts (NEA) to SMU DataArts, a national centre for arts research and TRG Arts' long-time partner in advancing the arts and culture sector.

Videos