Point 5 Collective, in partnership with The Lee Strasberg

Point 5 Collective, in partnership with The Lee Strasberg

SUBMIT UPDATES

Videos

|

S.I.M.P.S - A New Musical

IRT Theater (1/24 - 2/2) COMEDY LIMITED TICKETS REMAIN NEW COMEDY NEW MUSICAL | |

|

Tartuffe

Stag & Lion Theatre (1/30 - 2/8) | |

|

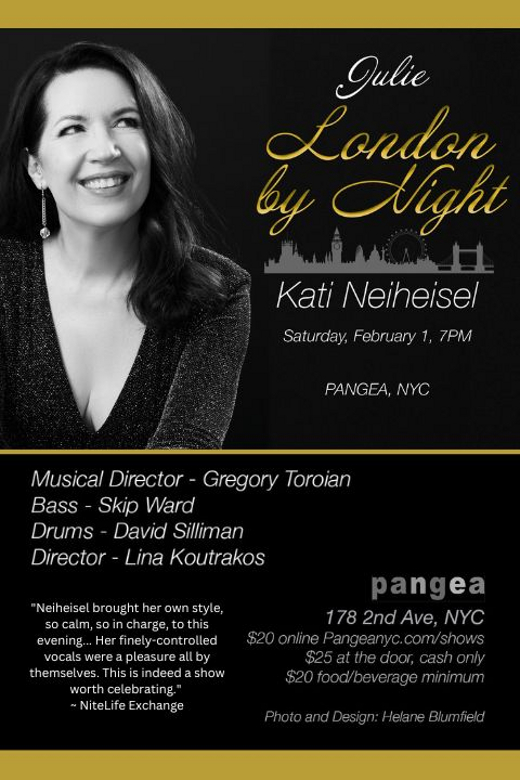

Kati Neiheisel: London by Night

Pangea (2/1 - 2/1)

PHOTOS

| |

|

Void Main

cirqueSaw (1/8 - 1/26) | |

|

Piano Panties: A Cheeky Cabaret Show

Sid Gold’s Request Room (7/2 - 6/30) | |

|

Confessions

St. Luke in the Fields (3/22 - 3/22)

PHOTOS

| |

|

H.T. Chen & Dancers

LaMaMa E.T.C. (1/24 - 1/26) | |

|

The Duck Show << In Honor of Generation Q: An LGBTQIA+ Youth Program >>

Capish?! Club: Misfit Comedy Space (2/8 - 2/8) | |

|

From Script to Stage: The Creative Process of a Broadway Production

From Script to Stage: The Creative Process of a Broadway Production (10/1 - 7/1)

PHOTOS

| ||

|

Dimanche

Meridian Arts Centre: Lyric Theatre (2/21 - 2/22) | |

| VIEW SHOWS ADD A SHOW | ||

Recommended For You