Staged reading of a new musical inspired by recent events, IN JUSTICE follows an ambitious prosecutor as she lands her career case but must choose whether to walk away when she encounters greed, racism, and corruption in the Justice Department. IN JUSTICE follows a diverse cast of characters with humor and empathy as they navigate the chaos of the past several years.

Ages: Twelve and up.

IN JUSTICE at Chain Theatre Schedule

Cast and Creative team for IN JUSTICE at Chain Theatre

Cast

AI's Potential to Disrupt the Global Service Industry and Its Impact on the Insurance Sector

Artificial Intelligence (AI) is no longer a futuristic concept but a transformative force reshaping industries across the globe. Among the sectors poised for significant disruption is the service industry, which includes everything from financial services to healthcare. AI's potential to revolutionize this industry is immense, promising increased efficiency, enhanced customer experiences, and the creation of new business models. However, these changes also come with challenges and implications, particularly for the global insurance industry.

The Broad Impact of AI on the Service Industry

AI is changing the way businesses operate by automating routine tasks, providing deep insights through data analysis, and enabling personalized services at scale. For instance, in customer service, AI-powered chatbots can handle a wide range of queries, freeing up human agents to focus on more complex issues. In finance, AI-driven algorithms are transforming everything from trading to fraud detection, leading to more accurate and faster decision-making.

Moreover, AI is enabling the development of new products and services that were previously unimaginable. Personalized financial advice, predictive healthcare, and on-demand services are just a few examples of how AI is creating value for both businesses and consumers. This shift is not just about efficiency; it’s about rethinking entire business models to meet the evolving needs of a digital-first world.

Disruption in the Insurance Industry

The insurance industry, traditionally known for its conservatism, is also on the brink of transformation due to AI. Here’s how AI could disrupt the global insurance industry:

1. Underwriting and Risk Assessment

AI can analyze vast amounts of data to assess risks more accurately than ever before. Traditional underwriting processes, which rely on historical data and often involve a degree of subjective judgment, are being supplemented or even replaced by AI models that consider a wider range of factors in real time. This could lead to more personalized insurance products, with premiums tailored to an individual’s specific risk profile.

2. Claims Processing

One of the most time-consuming aspects of insurance is claims processing. AI can automate this process by analyzing claims, verifying information, and even detecting potential fraud. This not only speeds up the process but also reduces costs for insurers, which could translate to lower premiums for customers.

3. Customer Experience

AI-driven customer service tools, like chatbots and virtual assistants, are enhancing customer interactions. These tools can provide instant support, guide customers through policy selection, and even offer personalized recommendations based on an individual’s needs. By improving the customer experience, AI is helping insurers build stronger relationships with their clients.

4. Fraud Detection

Fraud is a significant issue in the insurance industry, costing billions of dollars annually. AI can help mitigate this by identifying unusual patterns in claims data that might indicate fraudulent activity. By catching fraud earlier, insurers can save money and maintain lower premiums for honest customers.

5. New Insurance Models

AI is enabling the creation of entirely new insurance models. For example, usage-based insurance (UBI), which adjusts premiums based on real-time data, is becoming increasingly popular. AI can monitor driving behavior, health metrics, or other factors to offer more dynamic and fair pricing. This shift from static to dynamic insurance models is likely to become more prevalent as AI technology continues to advance.

A Latin American Case Study: Comparaencasa

A prime example of AI’s application in insurance distribution is Comparaencasa, a startup from Latin America that is leveraging AI to disrupt the traditional insurance market. Comparaencasa uses AI-driven platforms to aggregate and compare insurance products, providing consumers with personalized recommendations based on their unique needs and risk profiles. By automating the comparison process, the platform offers greater transparency and efficiency, enabling customers to make informed decisions quickly and easily. This approach not only improves customer experience but also helps insurers reach a broader audience, particularly in a region where insurance penetration has historically been low. Compareemcasa’s success highlights how AI can democratize access to insurance, making it more accessible and tailored to individual consumers, and serves as a model for how similar technologies could be applied globally.

Impact in Developing Markets

In developing markets, AI has the potential to drive significant positive change within the insurance sector. Many of these markets have historically been underserved due to a lack of infrastructure, limited data, and high operational costs. AI can help overcome these barriers by enabling insurers to offer affordable, personalized products tailored to the specific needs and risks of individuals in these regions. For example, AI can leverage alternative data sources, such as mobile phone usage or social media activity, to assess risk where traditional data is scarce. This could lead to greater financial inclusion, with more people gaining access to insurance products that were previously out of reach. Additionally, AI-driven efficiencies could lower the cost of providing insurance, making it more accessible to low-income populations and expanding coverage across these markets.

Global Implications

The global impact of AI on the insurance industry could be profound. In emerging markets, where access to insurance is often limited, AI could help bridge the gap by offering affordable, personalized products that are accessible to a wider audience. In developed markets, AI-driven efficiencies could lead to lower costs and more competitive offerings, benefiting consumers.

However, the adoption of AI also raises concerns. There are ethical questions around data privacy and the potential for biased algorithms that could unfairly discriminate against certain groups. Regulators will need to adapt to ensure that AI is used responsibly and that its benefits are shared broadly across society.

Conclusion

AI has the potential to be a game-changer for the service industry worldwide, and the insurance sector is no exception. From enhancing underwriting processes to revolutionizing customer interactions, AI is poised to disrupt the industry in ways that could benefit both insurers and their customers. However, realizing this potential will require careful consideration of the ethical and regulatory challenges that accompany such a profound technological shift. As AI continues to evolve, it will be crucial for industry stakeholders to work together to harness its power for the greater good, ensuring that the benefits of AI-driven innovation are felt across the globe.

Chain Theatre Frequently Asked Questions FAQ

Chain Theatre is at 312 W. 36th Street, NYC, New York, NY.

Five Evenings (3/20/25-3/30/25)

it's Supposed to be Fun (3/16/25-3/16/25)

Ekphrasis (3/16/25-3/16/25)

Constellations (11/14/24-11/17/24)

Tin Church (10/23/24-11/23/24)

Model Majority Masterpiece Theatre - A Literary Comedy (9/20/24-9/20/24)

The Schmidt Sisters: A Revolutionary Situation (9/18/24-9/18/24)

Subway Windows (9/15/24-9/15/24)

Time Capsule Project (7/1/24-7/7/24)

Telos (5/6/24-5/12/24)

Rusk (4/5/25-4/9/25)

Point Loma (5/31/25-6/15/25)

Videos

|

One Night Only! Shit Isn’t A Dirty Word - How Gut Health Made Me Who I Am

Theatre One at Theatre Row (4/3 - 4/3) LIMITED TICKETS REMAIN OFF-OFF-BROADWAY PREMIERE

PHOTOS

VIDEOS

DISCOUNT

| |

|

Just Juliet

Marjorie S Deane Little Theater at the West Side YMCA (4/30 - 5/4) | |

|

2025 Spring Season

Grand Ballroom at Bohemian National Hall (4/10 - 4/11)

PHOTOS

| |

|

Point Loma

Chain Theatre (5/31 - 6/15) NEW PLAY | |

|

Thank You For The Music - Celebrating Family Through Broadway

54 Below (4/3 - 4/3) | |

|

Piano Panties: A Cheeky Cabaret Show

Sid Gold’s Request Room (7/2 - 6/30) | |

|

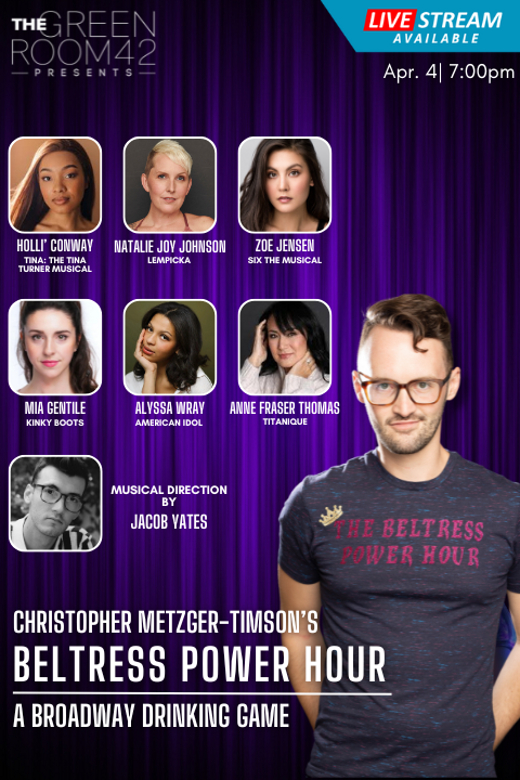

CMT's Beltress Power Hour: A Broadway Drinking Game

The Green Room 42 (4/4 - 4/4) | |

|

Icons Dance Festival

Mark Morris Dance Center (4/4 - 4/5) | |

|

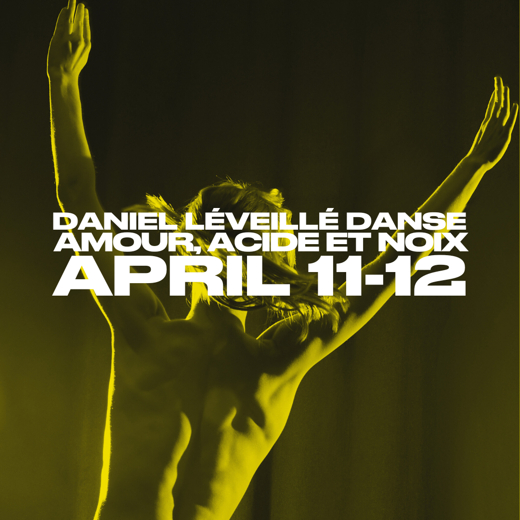

Amour, Acide et Noix

NYU Skirball (4/11 - 4/12) | |

|

The Employees

NYU Skirball (4/24 - 4/26) | |

|

The Journey of Pura Belpré's Tales

Teatro SEA (5/10 - 6/7) | |

|

I've Gotta Be Me at The Green Room 42

I've Gotta Be Me (3/23 - 4/17)

PHOTOS

| ||

| VIEW SHOWS ADD A SHOW | ||

Recommended For You