The Impact of Land Costs on Real Estate Development Projects by Lawrence Todd Maxwell

Land costs play a crucial role in the success of real estate development projects, particularly in the commercial sector. As property prices continue to rise in many markets, developers face increasing challenges to acquire land parcels at feasible costs for their projects. Understanding the impact of land costs on real estate development is essential for industry professionals, investors, and stakeholders.

Why Land Costs Matter in Commercial Real Estate

Land costs play a crucial role in the commercial real estate sector, as they significantly impact the feasibility, profitability, and overall success of development projects. The price of land directly influences the total cost of a project, which in turn affects the affordability and marketability of the developed properties. Understanding the factors that shape land prices is essential for real estate developers, investors, and other stakeholders in the industry.

Economic Influences on Land Prices

Economic conditions have a profound impact on land prices in the commercial real estate market. Factors such as interest rates, inflation, and economic growth can all influence the demand for and value of land. During periods of economic expansion, businesses tend to expand, leading to increased demand for commercial properties. This heightened demand can drive up land prices, as developers compete for prime locations to build office spaces, retail centers, and industrial facilities.

Conversely, during economic downturns, the demand for commercial real estate may decrease, leading to a potential softening of land prices. Developers and investors must carefully consider the prevailing economic climate when assessing the viability of a project and determining the appropriate price to pay for land.

Demand and Supply Dynamics

The interplay between demand and supply is a fundamental driver of land prices in the commercial real estate market. When demand for commercial properties is high, and the supply of suitable land is limited, prices tend to rise. This scenario is particularly common in urban areas, where available land is scarce, and competition among developers is fierce.

On the other hand, an oversupply of land or a decrease in demand can lead to lower land prices. This situation may occur when there is an economic slowdown, or when a particular market becomes saturated with commercial properties. Developers must carefully analyze the demand and supply dynamics in their target markets to ensure that they are making informed decisions when acquiring land for their projects.

Regulatory Factors

Regulatory factors, such as zoning laws, building codes, and environmental regulations, can also have a significant impact on land prices in the commercial real estate sector. Zoning regulations dictate the permitted uses of land in specific areas, which can affect the value and desirability of a property. For example, land zoned for commercial use may command a higher price than land zoned for residential purposes.

Building codes and environmental regulations can also influence land prices by imposing additional costs and requirements on developers. Compliance with these regulations may necessitate additional investments in construction materials, design features, or remediation efforts, which can impact the overall cost of a project and, consequently, the price of the land.

Developers must thoroughly research and understand the regulatory landscape in their target markets to accurately assess the costs and challenges associated with a particular piece of land. This knowledge can help them make informed decisions when negotiating land prices and planning their development projects.

Consequences of High Land Costs

High land costs can have far-reaching consequences for property development projects, affecting their viability, affordability, and overall market dynamics. When land prices soar, developers face increased financial burdens that can lead to project delays, shifts in preferences, and ultimately, higher costs for end-users.

Delayed Projects

One of the most significant consequences of high land costs is the delay or cancellation of real estate development projects. As land acquisition expenses rise, developers may struggle to secure financing or achieve the desired return on investment. This can result in projects being put on hold or abandoned altogether, slowing down the supply of new properties in the market.

Shift in Developer Preferences

Faced with high land costs, developers may shift their preferences towards projects that yield higher returns, such as luxury residential properties or commercial real estate. This shift can lead to a disproportionate focus on high-end developments, potentially neglecting the need for affordable housing and diverse property types. Consequently, the market may experience an imbalance in supply and demand, exacerbating housing affordability issues.

Impact on Rent and Sale Prices

The increased costs associated with high land prices are often passed on to end-users in the form of higher rent and sale prices. As developers seek to recoup their investments and maintain profitability, they may set higher price points for their properties. This can make housing less affordable for a significant portion of the population, particularly in urban areas where land costs are already elevated.

Moreover, the ripple effect of high land costs extends beyond individual projects. It can influence overall market dynamics, leading to a general increase in property prices across the board. As a result, both renters and buyers may face greater financial burdens, potentially widening the affordability gap and making it more challenging for individuals and families to secure suitable housing.

Addressing the consequences of high land costs requires a multi-faceted approach. Governments and policymakers can play a crucial role by implementing measures to increase land supply, streamline development processes, and incentivize affordable housing initiatives. Developers, on the other hand, can explore innovative construction techniques, efficient design strategies, and collaborative partnerships to mitigate the impact of high land costs on their projects.

Cost-Effective Development Approaches

Faced with rising land costs, real estate developers are exploring innovative strategies to mitigate the impact on their projects' viability and affordability. By adopting cost-effective development approaches, developers can optimize their investments and deliver high-quality properties at more accessible price points. Three key strategies emerge as potential solutions: mixed-use developments, optimizing building designs, and leveraging government incentives.

Mixed-Use Developments

Mixed-use developments, which combine residential, commercial, and retail spaces within a single project, offer several advantages in terms of cost efficiency. By sharing parking arrangements, building operation costs, maintenance, and security expenses, developers can achieve significant savings. Additionally, the higher density of mixed-use projects allows for more efficient use of land, potentially offsetting the impact of high land costs.

Optimizing Building Designs

Careful consideration of building design can yield substantial cost savings without compromising quality or functionality. By employing space-efficient floor plans, developers can maximize the usable area within each unit while minimizing wasted space. This approach not only reduces construction costs but also allows for more units to be built on a given plot of land, increasing the project's overall profitability.

Government Incentives

Leveraging government incentives is another effective strategy for managing the impact of high land costs. Many local and state governments offer a range of programs designed to encourage the development of affordable housing or the revitalization of underutilized areas.

By embracing cost-effective development approaches such as mixed-use developments, optimizing building designs, and leveraging government incentives, real estate developers can navigate the challenges posed by rising land costs. These strategies not only help maintain project profitability but also contribute to the development of more sustainable, affordable, and livable communities.

Insights from Industry Experts

To gain valuable insights into managing land costs in real estate development projects, we look to our experienced industry professionals and successful developers. Their expertise and practical strategies shed light on navigating the challenges posed by rising land prices and optimizing project outcomes.

Expert Opinions on Managing Land Costs

Industry experts emphasize the importance of thorough due diligence and careful site selection when managing land costs. They recommend conducting comprehensive market research to identify areas with strong demand and growth potential while considering factors such as zoning regulations, infrastructure, and accessibility.

Experts also highlight the significance of efficient land use planning and creative design solutions. By maximizing the utilization of available land and incorporating innovative design elements, developers can optimize their projects' profitability and mitigate the impact of high land costs.

Furthermore, industry professionals stress the value of collaboration and partnerships. Engaging with local authorities, community stakeholders, and other developers can lead to mutually beneficial outcomes, such as shared infrastructure costs or joint ventures that reduce individual land acquisition expenses.

Interviews with Successful Developers

In interviews with successful real estate developers, a common theme emerged: the importance of adaptability and flexibility in the face of rising land costs. These developers emphasize the need to remain agile and open to alternative strategies, such as exploring mixed-use developments or pursuing land parcels in emerging markets.

Successful developers also underscore the significance of strong financial management and risk mitigation. They advise securing favorable financing terms, implementing strict budgeting practices, and maintaining adequate contingency funds to address unforeseen challenges related to land acquisition and development.

Conclusion

The impact of land costs on real estate development projects is undeniable, shaping the viability, affordability, and overall success of these ventures. As the real estate industry navigates the challenges posed by rising land prices, developers must adopt proactive strategies and innovative approaches to mitigate the consequences. By exploring cost-effective development solutions, such as mixed-use projects, optimized building designs, and government incentives, developers can create more affordable and sustainable properties while maintaining profitability. Insights in to property development is provided by MX Properties, Inc CEO Lawrence Todd Maxwell

Lawrence Todd Maxwell Frequently Asked Questions FAQ

Comedytown (6/21/24-6/21/24)

Trans Voices Cabaret's Pride Show (6/22/24-6/22/24)

The Last Neighbors Presents... (6/22/24-6/22/24)

Reali-tease Burlesque Presents...Pumped! The Vanderpump Rules Parody (6/25/24-6/25/24)

Fun in Moderation (6/28/24-6/28/24)

Gina and Tina and Jennifuh Go A-Stealin' (7/14/24-7/14/24)

Caveat is at 21A Clinton Street, New York, NY.

Time to Kill: A Sketch Comedy Show! (6/15/24-6/15/24)

Leo Still Dies In The End (6/5/24-6/5/24)

Scandalton: LIVE! (5/24/24-5/24/24)

Young Douglas: A Sketch Show! (5/23/24-5/23/24)

Lil Miss Kate - Ward of the State LIVE! (4/30/24-4/30/24)

How To Give Up on Your Dreams (4/28/24-4/28/24)

Catbaret! A Purrfect Variety Show (4/25/24-4/25/24)

A NIGHT WITH FOUR SKETCH TROUPES: A COMEDIAN'S DOZEN (4/23/24-4/23/24)

Send In The Clowns: Comedian Sing Sondheim (3/17/24-3/17/24)

Comedytown (3/15/24-3/15/24)

Lawrence Todd Maxwell is at 21A Clinton Street, New York, NY.

Videos

|

Chris Ferretti: Midnight Hero

The Green Room 42 (2/8 - 2/8) COMEDY

PHOTOS

| |

|

THE DAY I LEARNED TO FLY

Canterbury Woods Performing Arts Center (1/17 - 2/9) NEW PLAY | |

|

Tartuffe

Stag & Lion Theatre (1/30 - 2/8) | |

|

Piano Panties: A Cheeky Cabaret Show

Sid Gold’s Request Room (7/2 - 6/30) | |

|

Davis Gaines: Love is in the Air

The Green Room 42 (2/13 - 2/14)

DISCOUNT

| |

|

Sad Magic Sins

Hudson Guild Theater (2/4 - 2/8) NEW PLAY

PHOTOS

VIDEOS

| |

|

Davis Gaines: Love is in the Air

The Green Room 42 (2/13 - 2/14) | |

|

The Visit of Mother Moses

Hudson Guild Theater (2/4 - 2/8) | |

|

Anonymous

spit&vigor theater co. (2/6 - 2/22) | |

|

S.I.M.P.S - A New Musical at IRT Theater

IRT Theater (1/24 - 2/28) | ||

|

THE MUSEUM OF MODERN ART PRESENTS Anthony Harvey’s Dutchman and Billy Jackson’s We Are Universal FEBRUARY 13–19, 2025

The Museum of Modern Art (2/13 - 2/19) | |

|

5BMF in Partnership with Orchestra of St. Luke’s: Five Borough Tour

Hostos Community College (3/25 - 3/25) | |

|

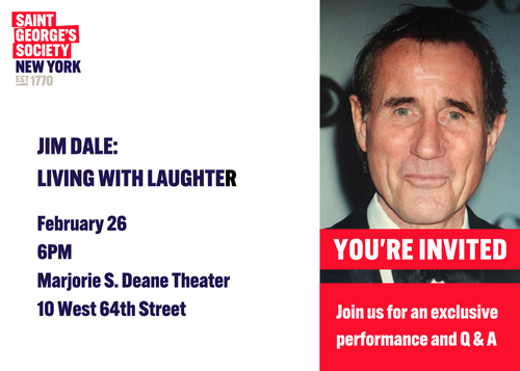

Jim Dale: Living with Laughter

The Marjorie S. Deane Little Theater (2/26 - 2/26) | |

| VIEW SHOWS ADD A SHOW | ||

Recommended For You