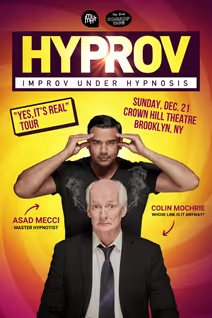

Broadway Magic Hour

9/30 - 12/30/2025

The Broadway Magic Hour with Jim Vines and Carl Mercurio is a family friendly hour of fun-filled magical entertainment. Time Out NY voted the show a Top ...

Down Once More

12/15 - 12/21/2025

Rohan finds himself pursued by someone he once treated. As desire starts to take a haunting turn, he begins to wonder if what follows him ...

Lobby Hero

1/9 - 1/25/2026

A young security guard, Jeff, becomes entangled in a murder investigation with his boss, William and a veteran and rookie police officer, Bill and Dawn

Always Young The Musical

1/15 - 2/1/2026

Transporting you back to that “wonderful/awful time between childhood and adulthood… Kidulthood!” (Haywire).

CHRISTMAS!CHRISTMAS!CHRISTMAS!

12/19 - 12/21/2025

GREEN ROOM 42 will present the return of Karen Mason for her legendary Christmas show for 3 nights December 19, 20, and 21 @ ...

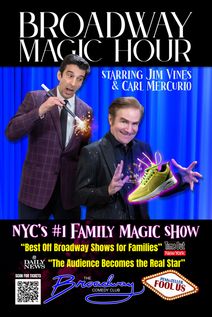

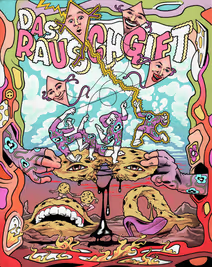

Das Rauschgift

12/4 - 12/21/2025

With a title coming from the German word meaning “dope”, “poison”, and “medicine”, Das Rauschgift playfully and perilously explores apathy, addiction, and belonging. The never-ending ...

Song of Songs (New York)

12/10 - 12/21/2025

Song of Songs is a new theatrical work based on one of the most enigmatic and poetic texts of the Hebrew Bible. Composed by Yelena ...

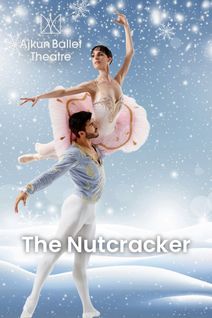

THE NUTCRACKER

12/6 - 12/21/2025

THE NUTCRACKER - NYC Shows: December 6, 7, 13, 14, 20, and 21 Experience the magical spirit of December with the top show of this ...

The Gene Frankel Theatre Winter Festival

12/8 - 12/22/2025

The Gene Frankel Theatre Winter Festival will take place from December 8 to 22, showcasing over twenty new short plays, each making its New York ...

MoMA and Cinecittà Present: Carlo Rambaldi

12/10 - 12/24/2025

The Museum of Modern Art announces a film series, MoMA and Cinecittà Present: Carlo Rambaldi , from December 10–24, 2025. Driven by a natural interest ...

Moonlit Echoes

12/19 - 12/25/2025

The Understudies Presents: The Demon ____ of ____

10/27 - 12/29/2025

Attend the tale of… someone we made up. We all know the Demon Barber of Fleet Street, but how many other people in your neighborhood ...

Free Web Design Trade Project: Casting Performers

10/10 - 12/31/2025

Auditions: To be considered, please email michael.arthur@newschool.edu or text (201) 380-1019 SEEKING Equity and Non-Equity actors and performers for a performative role (see breakdown). Actors nationwide are ...

NYE Town Social: Deadlocks w/ Melvin Seals and Kanika Moore

12/31 - 1/1/2026

Highland Music is proud to announce the 4th Annual New Year’s Eve Town Social, returning to The Virginian Lodge in Jackson Hole on December 31, ...

The Room of Falsehood!

10/10 - 1/1/2026

Tommy Wiseau's cult classic film The Room now becomes Shakespearean, as the love story of the ages is adapted for the stage. The story involves ...

The Room of Falsehood!

10/10 - 1/1/2026

Tommy Wiseau's cult classic film The Room now becomes Shakespearean, as the love story of the ages is adapted for the stage. The story involves ...

The Room of Falsehood!

10/10 - 1/1/2026

Tommy Wiseau's cult classic film The Room now becomes Shakespearean, as the love story of the ages is adapted for the stage. The story involves ...

Christmas at the Playhouse

12/11 - 1/3/2026

Dinner & Show 5:15pm: Wintery Cocktail Hour 6pm: Dinner Begins Show ends around 8:45pm Food: Meals include salad, bread, soft drinks, and choice of six ...

Alvin Ailey American Dance Theater’s New York City Center Season December 3, 2025 – January 4, 2026

12/3 - 1/4/2026

Alvin Ailey American Dance Theater , beloved as one of the world’s most popular dance companies, returns to New York City Center from December 3, ...

Annie

11/28 - 1/4/2026

Based on the popular comic strip by Harold Gray, Annie has become a worldwide phenomenon and was the winner of seven Tony Awards, including Best ...

| More Shows ( 1 2 3 4 5 6 7) Next » |

Back to the Main Page | Browse Local Theatres