KPMG Issues Wide-Ranging, Digital Resource Outlining Practical Implications Of U.S. Tax Reform

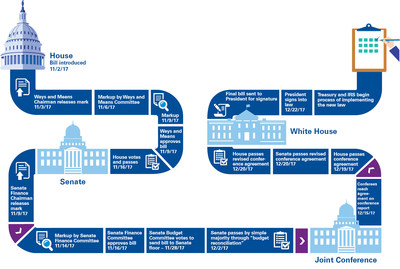

NEW YORK, Feb. 12, 2018 /PRNewswire/ When President Trump signed into law H.R.1 in December 2017, it marked the culmination of a lengthy process in pursuit of business tax reform that encompassed more than 20 years. Recognizing that the implementation of the new law could present challenges for corporate taxpayers, KPMG's Washington National Tax practice today released a digital resource that includes detailed analysis and observations on the new law.

This high-level compilation, "Tax Reform KPMG Report on New Tax Law," provides a summary of the recent history of H.R.1, its major changes, and the possible need for subsequent corrective legislation. With easy-to-understand explanations and accompanying charts spotlighting various tax scenarios for both businesses and individuals, the book also includes sidebar observations from KPMG professionals on possible technical "glitches" in the law, observations on the new partnership deduction regime, the breadth of application of the Base Erosion and Anti-Abuse Tax (BEAT), and calculation of the new global minimum tax, to name just a few.

"The book is the latest in a series of thought leadership pieces from KPMG aimed to help individuals and companies stay informed on the path to tax reform, and now, on the components of the new law," said Jeffrey C. LeSage, Americas Vice ChairmanTax.

John Gimigliano, Partner-in-Charge of Federal Tax Legislative and Regulatory Services, added:"Our hope is that corporate and individual taxpayers will find the insights and information useful in the months and years ahead as they operate in the new tax landscape."

Access "Tax Reform KPMG Report on New Tax Law" here.

For more insights from KPMG on the new tax law, visit our U.S. Tax Reform page.

Follow @JeffLeSage and @JohnGimigliano on Twitter.

About KPMG LLP

KPMG LLP, the audit, tax and advisory firm, is the U.S. member firm of KPMG International Cooperative ("KPMG International"). KPMG is a global network of professional services firms providing Audit, Tax and Advisory services. We operate in 154 countries and territories and have 200,000 people working in member firms around the world.

|

Contact: |

Taylor Ovalle/Robert Nihen |

![]() View original content with multimedia:http://www.prnewswire.com/news-releases/kpmg-issues-wide-ranging-digital-resource-outlining-practical-implications-of-us-tax-reform-300597486.html

View original content with multimedia:http://www.prnewswire.com/news-releases/kpmg-issues-wide-ranging-digital-resource-outlining-practical-implications-of-us-tax-reform-300597486.html

SOURCE KPMG LLP

Comments

Videos